The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Discover the most relevant industry news and insights for fashion professionals working in retail, updated each month to enable you to excel in job interviews, promotion conversations or perform better in the workplace by increasing your market awareness and emulating market leaders.

BoF Careers distills business intelligence from across the breadth of our content — editorial briefings, newsletters, case studies, podcasts and events — to deliver key takeaways and learnings tailored to your job function, listed alongside a selection of the most exciting live jobs advertised by BoF Careers partners.

Key articles and need-to-know insights for retail professionals today:

1. Lessons From LA’s Hottest Retail Destinations

Los Angeles is dotted with thriving brick-and-mortar retail concepts mostly built in the last two-plus decades even as hundreds of malls closed nationwide. The modernised Brentwood Country Mart is notable for having the first permanent Goop store. The Shops at Sportsmen’s Lodge touts LA’s most talked-about retailer as an anchor tenant: Erewhon Market. Platform, a 75,000-square-foot shopping alcove in Culver City, is almost entirely hidden from street view. And The Grove really does feel like an amusement park, with its own trolly system and dancing water fountain.

“People used to go to Sears because Sears had a large selection of stuff,” said Joey Miller, who founded Runyon Group, the real estate firm behind Platform, with business partner David Fishbein. “When they come out to shop today, it’s for curation. For perspective and entertainment … we conceded a long time ago that assortment belongs online.”

Related Jobs:

Store Manager, Ami Paris — Bicester, United Kingdom

Director, Field Operations Food Services, Bloomingdale’s — New York, United States

Sales Manager, Men’s Complex, Neiman Marcus — Denver, United States

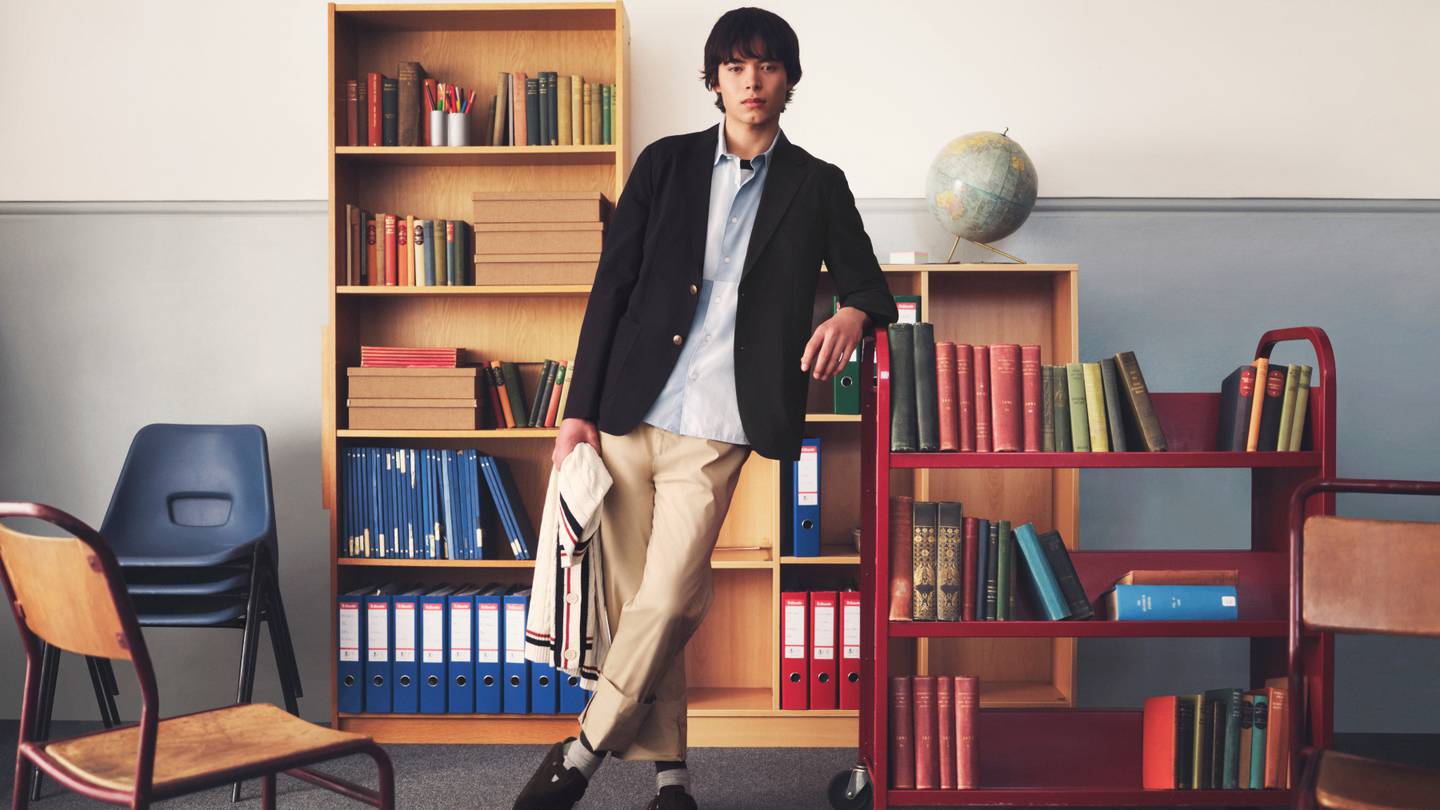

2. How Uniqlo Finally Won Over Gen-Z

A large section of wall space of Uniqlo’s newest flagship store in Covent Garden is dedicated to the $20 crossbody bag in dozens of colourways. Nearby, there’s a display featuring a screenshot of the TikTok that started it all — Caitlin Phillimore demonstrated how many of her belongings she was able to fit into the bag. There’s also a case containing replicas of all of those items.

Since Phillimore posted her ode to Uniqlo in April 2022, countless others have created “what’s in my bag” TikToks featuring the cross-body bag, and #uniqlobag has 70 million views on the platform. Uniqlo doesn’t usually get this kind of buzz, particularly with Gen-Z consumers in North America and Europe. The brand’s newfound status with Gen-Z has been a major driver of sales and profit growth in the past year, according to Taku Morikawa, Uniqlo’s chief executive for Europe.

Related Jobs:

Visual Merchandising Operations Specialist, AWWG — Madrid, Spain

Associate Store Director, Moncler — New York, United States

Store Operations Coordinator, Burberry — Busan, South Korea

3. RFID’s ‘Quiet Revolution’ in Retail

This March, Inditex announced it would eliminate its hard security tags, sewing RFID directly into garments. The move should help in “facilitating the use of self-scan checkouts and reducing a key source of customer friction at Zara — long queue times,” said RBC Capital analyst Richard Chamberlain. McKinsey has estimated the technology can boost inventory accuracy by more than 25 percent. One study of ten retailers including Adidas, C&A, Lululemon and Marks & Spencer by ECR Retail Loss Group, a working group of retailers and manufacturers, found similar accuracy gains, with resulting benefits including increased sales on lower levels of stock and reduced staff costs.

With RFID, you simply wave a wand over a tagged item to identify it. Inventory audits that once required long hours counting stock by hand every six or 12 months could be replaced with fast, frequent updates, letting stores know what needed to be replenished on the sales floor, what was out of stock and what wasn’t moving.

Related Jobs:

Stock Controller, Dover Street Market — London, United Kingdom

Merchandising Planner / Allocator, Scotch & Soda — Paris, France

Senior Manager, Store Operations Technology, Calvin Klein — New York, United States

4. Who Will Win Japan’s Luxury E-Commerce Race?

The pandemic-induced surge in e-commerce that was felt everywhere was even more pronounced in Japan, a long-time digital laggard compared to other mature markets. Between 2019 and 2021, Japan’s fashion e-commerce market grew 27 percent, rising to 2.4 trillion yen ($18 billion), according to Koyu Asanuma, a channel partner overseeing the Japanese market for trend forecaster WGSN. The broader e-commerce industry grew 30 percent during the same period, according to data from Japan’s Ministry of Internal Affairs and Communication.

The shift was confirmed by a survey conducted last year by McKinsey which found that 41 percent of Japanese luxury consumers are researching and purchasing across channels including digital ones, rather than heading straight to department stores and boutiques. Having worked hard on growing their e-commerce business before the pandemic hit, a few multi-brand boutiques are now reaping the rewards instead of playing catch-up.

Related Jobs:

Head of Digital Platforms, ME+EM — London, United Kingdom

E-commerce Project & Content Assistant (Internship), Maison Margiela — Paris, France

Director, E-Retail Growth, Tiffany & Co. — New York, United States

5. Lacoste Bets on New Store Concept to Propel Sales to €4 Billion

To drive its next chapter of growth, Lacoste is betting on bigger and better retail stores. In April, the brand opened the doors of a new 900 square metre flagship on London’s Regent Street. It’s the second store to adopt the brand’s new “Lacoste Arena” concept, which aims to showcase a wider product offering to shoppers in larger, more experiential spaces.

The retail strategy is part of a plan to propel Lacoste, owned by Swiss holding group Maus Frères, past €4 billion in annual revenues by 2026, said Spindler; the resurgence of physical retail since the end of the pandemic has helped spur the brand forward, she said, with sales hitting the €2.5 billion mark last year, up 26 percent year on year.Going forward, the brand sees potential to further grow its womenswear business, as well as its footwear and technical sports lines, under the guidance of new creative design director Pelagia Kolotouros.

Related Jobs:

Shop Manager, Paul Smith — London, United Kingdom

Visual Identity and Merchandising Specialist, Maison Margiela — Paris, France

Senior Director, Store Planning (Retail Design), Alexander Wang — New York, United States

6. Wealthy Chinese Flock to High-Octane Shopping Hubs

It’s not until this quarter or the second half of the year that most destinations will see a bigger wave of outbound visitors, says the China Outbound Tourism Research Institute (COTRI). It’s forecasting 110 million outbound trips from the mainland this year which is just two-thirds of the traffic seen in 2019.

Global Blue, the tax free retailer, said that in March mainland Chinese spending in Europe had already reached nearly half of what it was in 2019, a big rise from the 22 percent seen in the first two months of the year. The recovery is expected to gradually strengthen in the months ahead but the COTRI predicts that Chinese outbound travel won’t overtake pre-Covid levels until next year. Capacity issues will continue to hinder progress until then. A significant backlog in Chinese passport renewals and fewer flights have made it difficult or, at the very least, more expensive to travel.

Related Jobs:

Assistant Store Manager, Acne Studios — Berlin, Germany

Coordinator, Chanel Handbags, Neiman Marcus — New York, United States

Retail Merchandiser, Prada Woman Shoes, Prada Group — Seoul, Korea

7. Why Fashion Hasn’t Given Up on Social Commerce

Asian markets have seen success in fusing social media and e-commerce. In the West, however, the uptake is slower. In 2022, sales through social platforms surpassed $400 billion in China but reached just $53 billion in the US during the same period, according to estimates from Insider Intelligence. Yet, there’s room for growth: Insider Intelligence estimates that orders placed through social media in the US will reach $130 billion by 2026. And platforms aren’t giving up just yet.

Despite talk of a potential ban, companies piloting new selling features are hoping to recalibrate. TikTok is ramping up its commerce offering in the US, and has been testing direct checkout since last November. Meanwhile, brands that are investing in platforms with newer and existing features are managing their expectations of what social selling can help them achieve. They’re also balancing how to embrace social commerce without diverting sales from their own sites.

Related Jobs:

Assistant Store Manager, Scotch & Soda — Denver, United States

E-Commerce Operation Supervisor, Wechat & .CN, Tiffany & Co. — Shanghai, China

Retail & Education Manager, Acqua Di Parma, Chalhoub Group — Dubai, UAE

8. It’s Time to Rethink Your China E-Commerce Strategy

It’s been over two years since Chinese authorities suddenly pulled the plug on the public listing for Alibaba-owned Ant Financial in an apparent retaliation to comments made by founder Jack Ma about government regulators. The crackdown led to Alibaba being fined $2.8 billion in 2021 for coercing merchants into exclusive listings on its platform. Then late last month, the firm announced a dramatic restructuring, which will carve up a tech empire that spans e-commerce, cloud computing, logistics, media and entertainment built over the last 24 years.

The breakup is also intended to address government concerns surrounding any one private sector company growing too powerful. It’s still too early to tell how the situation will shake out. For now, most international fashion and beauty brands and TP companies (third-party ‘Tmall partners’ that brands use to outsource their relationship with Alibaba’s main platform) appear to be treating it as business as usual.

Related Jobs:

Manager Client Relations, Southern Europe, Tiffany & Co. — Milan, Italy

Luxury Assistant Business Manager, Neiman Marcus — New York, United States

Personal Shopping Lead, Level Shoes, E-Commerce, Chalhoub Group — Dubai, UAE

In a post-Covid retail landscape where consumers are seduced by the convenience of e-commerce, brands are introducing technology in store in an attempt to replicate that ease.

A potential US debt default threatens to spoil a surprisingly strong run by major retailers, which are seeing resilient consumer spending.

Reliable sizing, sweet-spot pricing and contemporary – but not faddish – styles are helping high street retailer stand out.

The fast fashion retailer reportedly raised funding this week at a lower valuation. But the e-commerce giant remains immensely popular — and may have some more tricks up its sleeves.